Reposted from the Huffington Post

*****

End Budget Conflict Via Balanced Trade

Greg Autry | March 12, 2013 | Huffington Post

While the tax or slash battle rages on in Washington it would be a really good time to consider an alternative to this vicious cycle: halt the wealth transfer machine we call “trade policy.” A business that runs 30 years of losses has to cover the shortfalls eventually. Our long running and ever-growing trade deficit has flat lined American wages, dug an unemployment pit we can’t climb out of, and deprived the Treasury of trillions in income tax revenues — hence, the fiscal chaos in the capital.

For more than a generation we have been testing a self-destructive theory whereby we export enormous amounts of American capital, priceless technology and millions of jobs to other nations naively expecting them to reciprocate. Instead, what we get are cheap consumer goods and stale promises of access to illusionary markets — markets, our “trading partners” reserve for their own national champions.

And actually, that’s fine. China, Germany, and the Asian tigers have captured a lot of wealth and raised incomes for their people (albeit, China less equitably). It’s a successful strategy and I’m not suggesting we can or should make them change it. Nor do I believe that America should withdraw from the world because we aren’t tough enough for the game. If we played like a team we could stem our trade deficit, and take a chunk out of our fiscal deficit as well as correct the structural economic problem that makes our entitlement obligations unsustainable.

Trade Deficit and the Short Run

The Keynesian model calculates national output as a summation components represented in this equation.

GDP = Consumption + Investment + Government + net eXports

Politicians and TV economists never look beyond consumer and government spending which has dangerously unbalanced our economy. We can’t spend our way to prosperity. Instead, we must produce more of what we consume. Doing so would generate massive job creation, economic growth and tax revenue without changing the tax code.

So, let’s consider the X factor, exports minus imports, a growing negative number that’s a serious drag on our growth. If we could magically eliminate our $600Billion trade deficit the American economy could be roaring along at 5-6% growth rather than an anemic 2%. That’s the difference between the robust America of the 90s and the current nightmare, without any additional government spending and without any asset bubbles.

Let’s imagine we had market barriers similar to the ones the Chinese and Germans use so effectively to block American products. Then imagine a tariff of 30% on Chinese imports to partially neutralize that country’s strategic policies of currency manipulation, export subsidies, intellectual property theft, environmental abuse, and abysmal labor standards. Trade deficit gone.

Now, I’m not naïve. Two bad things would happen right away:

1. Prices of Chinese junk at Wal-Mart would go up, reducing Consumption.

2. China would retaliate reducing eXports.

That would depress GDP and the TV economists and business profs would all be singing their trade war anthem while dancing the Smoot-Hawley shake. But consider:

1. Most consumption is expenditures on domestic services like housing and health care.

2. Americans will not cut their spending by an amount as large as the price increase because even demand for Chinese junk is not perfectly elastic.

3. Fat manufacturers, like Apple, will take a margin hit.

4. Even in the short-run, Wal-Mart will find many American substitutes that cost less than the now expensive Chinese junk.

5. Mercantilist nations are already only importing the stuff they can’t make themselves - the day China makes a decent jet engine will be the last day they buy an American one. They also need our commodities to support their economy. They will huff and puff, but it would hard for them to actually do more damage to America than they are already doing.

C will not fall by nearly as much as X rises. A few other things would also happen.

1. American and Foreign firms will find it more advantageous to produce products in America, and the business Investment component of GDP will rise.

2. The tariff will generate billions in government revenues.

3. Multinational corporations will be less able to duck corporate taxes (a rate that should be slashed) and hide their cash off-shore.

4. American workers will leave the unemployment and welfare lines and start paying income tax again, both reducing spending and increasing tax revenue.

All of this will reduce the fiscal deficit and grow our GDP. And the real cost of goods will be more affordable because our income and wealth will rise more than the cost of consumption.

This is not a new plan. It’s the plan that successful producing and trading nations utilize, like Germany and South Korea. It’s the plan that they learned from the United States… the one we followed to become a global economic power. We need to relearn that lesson and restore balance to our GDP equation.

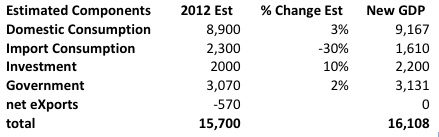

Hipshot Estimates

The following are some “back of the envelope” calculations of the impact on GDP of America getting serious about trade.

Greg Autry is the author of Death by China and serves as Senior Economist for the American Jobs Alliance and Economist with the Coalition for a Prosperous America. He teaches Macroeconomics at theArgyros School of Business and Economics at Chapman University. You can find him on Facebook.